The most important step in managing your finances is actually the basic first step that many fail to do: track their finances without judgement, without repercussions, just simple recording.

But it’s that simple habit of documenting transactions that lead to huge insights, which create the biggest ripples of positive financial changes for you. All you gotta do is take note of your transactions. Yep. That’s it.

If the thing is so simple, why do most people not do the thing?

It’s most likely because of one (or more) of the reasons below:

- You’re afraid to see where your money goes. In which case, you’re approaching it with judgement. That’s not necessary and it’s holding you back. Get rid of it. All you need to do is write down your spending.

- You’re not sure how to properly record your spending. What should you focus on? Cash flow? Assets & liabilities? Both? Or: what the heck do those words even mean? (Tracking cash flow just means monitoring what comes in and goes out of your accounts. If you have a full system going, then tracking this activity would automatically update your account balances — in which case you’re now monitoring your assets & liabilities. But for now we’re focusing on the first step — tracking cash flow. Which is uber important and lays the groundwork for everything else. The second step will not give you insights that this first step will.)

- OR, you’re overcomplicating it and you’ve created a system that has become too unwieldy and cumbersome for you to keep up. You record every detail. You’ve created categories and subcategories. You’ve created a column to describe every item purchased. Gold star, but if it keeps you from actually tracking, then no beuno. Time to scale back.

“If you find yourself not doing it, reduce the amount of time that you’re taking for it.”Ryder Carroll, inventor of the Bullet Journal.

The Only 2 Things You Need to Know/Do to Track Your Finances:

- Your process should not take more than 5 minutes to do. Getting it done and out of the way is more important than building elaborate and complicated systems that you give up on after a couple of weeks or days. All you need to do to succeed is to quickly jot down what you spent.

- It should just measure cash flow (what’s coming in vs what’s going out). If you’re not tracking your spending regularly, then most likely the most important thing for you at this point in time is to focus on not spending more than you’re earning. Therefore, the only thing you need to track is what’s coming in against what’s going out.

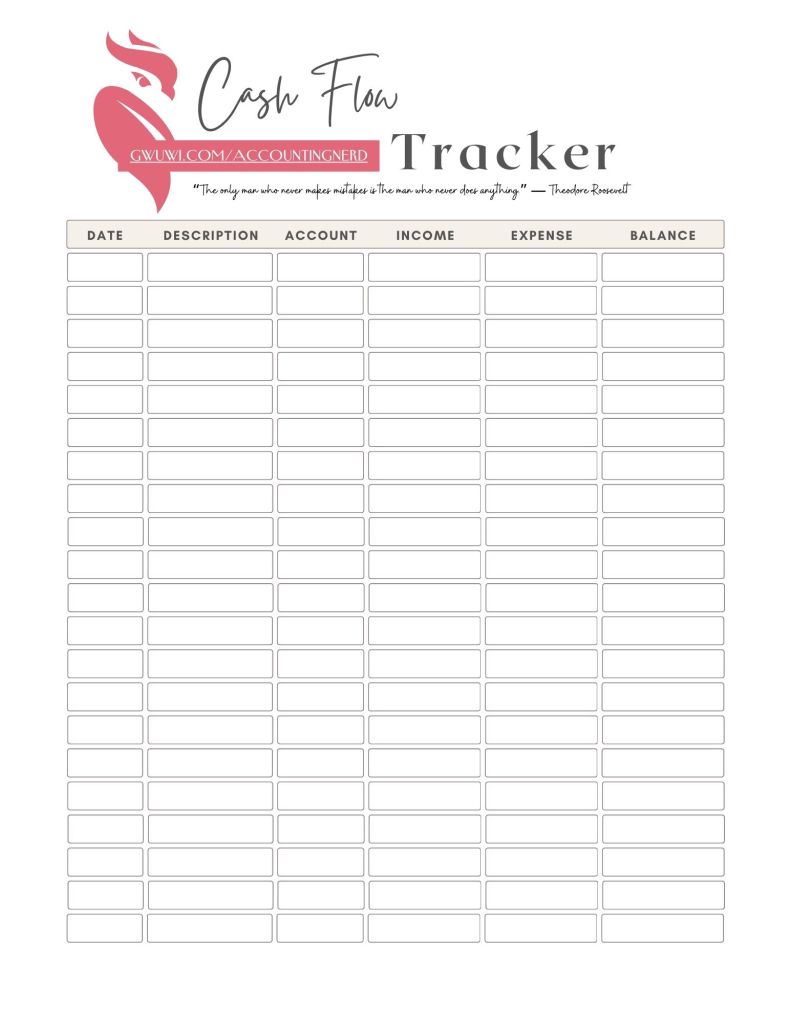

Just tracking your spending can get you ahead. For the next 3 months, try using the free printable below to track your income & expenses on a daily or weekly basis to get an idea of where you are financially. See below for instructions.

Free Printable

Browse Pages:

Free Download

Instruction/Description:

- First page is the example page which illustrates how to fill out the template.

- Opening balance = the total amount of cash you have across all your working accounts. Don’t look at your savings. Just whatever you have to ‘operate’ daily, usually what’s in your chequing or everyday account.

- Debt repayment = if you’re not recording your transactions, I’m assuming you might have a good amount of debt that you want to tackle. Whatever you have left over at the end of the month, put towards paying down your debt. (If you have a negative balance, don’t worry, that can be tackled later.)

- Don’t try to record your savings or your debt. Whatever’s there is there. Right now, we’re just going to focus all our attention on what’s coming in and what’s going out.

- Record your transactions for at least 60 days with no judgments. Just write it down. If you see things that can be changed easily without much of an impact on you (e.g., subscriptions to services you never use), feel free to cancel them. Otherwise, if you feel an emotional attachment to them, keep them on and just keep tracking.

If You Like it, Put a Pin on It

What’s the one thing that’s keeping you from tracking your finances? Is it because you feel like you have a good handle on things already? Or did you want to but didn’t know where to start? Or were you worried about seeing where your money was going? What would help you to start tracking now? What are some financial goals you’ve set for yourself? Do you think that tracking your finances now could help you achieve your dreams for the future?

Leave a comment